Review the 3D printing trends to keep an eye on this year. Our latest article has the perspective of more than 40 additive manufacturing insiders.

According to market intelligence specialist CONTEXT’s latest industry report, the recent return of in-person trade events has led to a renewed interest in 3D printing which has carried through into the order books of 3D printer manufacturers.

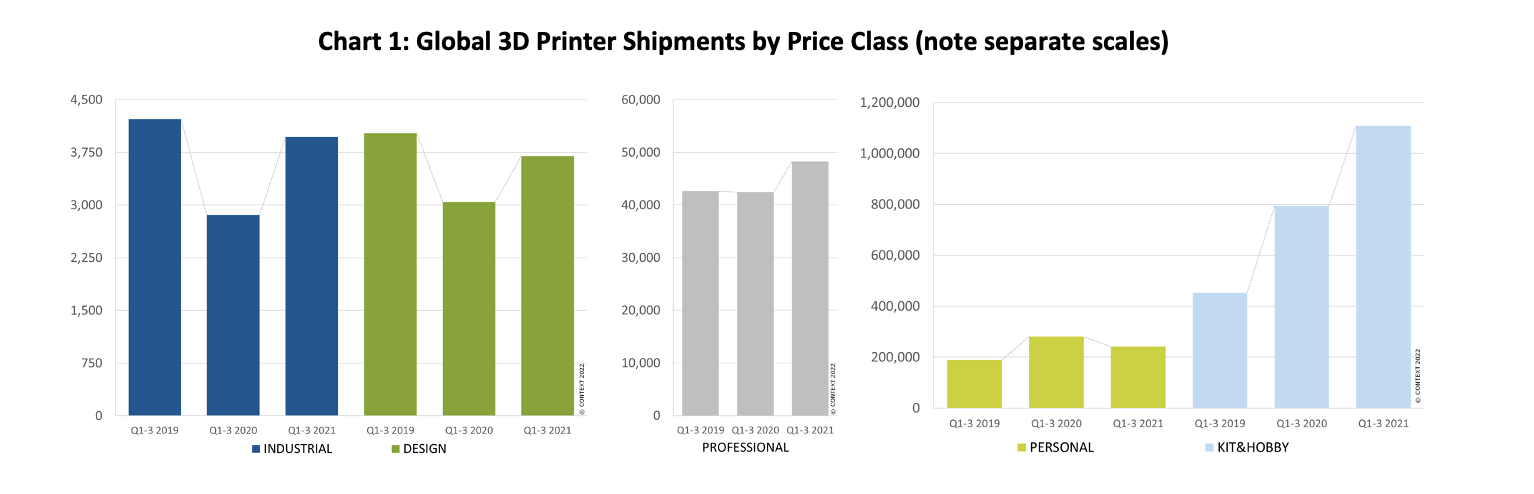

The report states that shipments of industrial 3D printers priced over $100,000 were up 39 percent throughout the first three quarters of 2021, although remained 6 percent down on pre-Covid levels. However, the firm says that while shipments of new high-end printers grew over Q3 2021, in many cases demand outstripped supply due to the rise of the omicron variant and various supply chain woes, leaving 3D printer shipments in H2 2021 limited.

Despite this, CONTEXT says the market is now “poised for strong growth” as it heads into 2022, with demand for consumer-targeted printers remaining higher than pre-pandemic levels over the first three quarters of 2021.

Accelerating industrial 3D printer orders

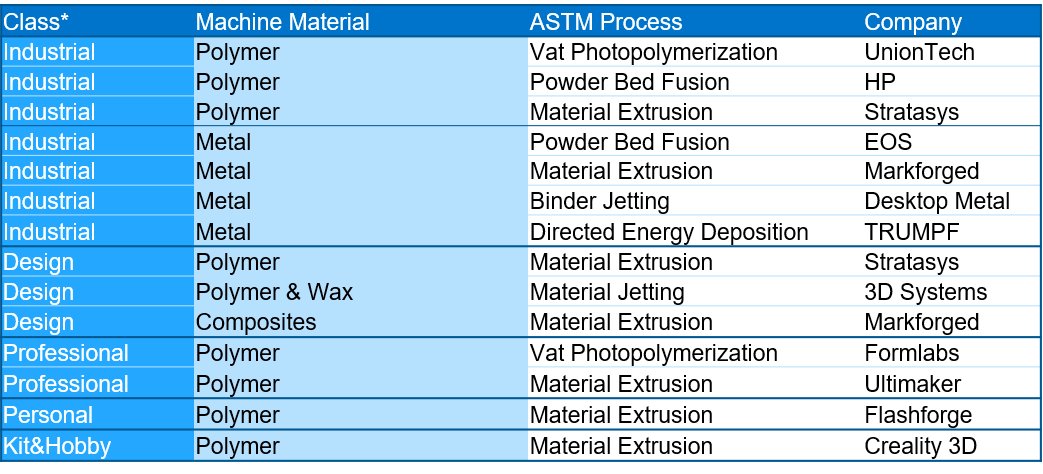

CONTEXT’s latest figures echo the trend of its previous quarterly reports throughout 2021, finding industrial 3D printer shipments have continued to bounce back after a Covid-hit 2020. During 2021, CONTEXT observed shipments of industrial and “design” printers – those defined here as selling for over $20,000 – rebounded strongly across the globe, while the recovery of Western 3D printing markets continued to gather pace towards the end of the year.

Despite this, the report says that the number of new high-end printers sold during 2021 still lagged behind pre-Covid levels, with industrial printers down six percent compared to Q1-Q3 2019. According to CONTEXT’s report, the strongest demand within the industrial 3D printer sector during 2021 was seen from printers focused on production or mass customization. In fact, polymer vat polymerization printers were found to be 22 percent up on 2019 levels, while demand for metal binder jetting models soared 104 percent.

In particular, CONTEXT identified resin vat polymerization 3D printers remained heavily in-demand from the dental industry across the globe, with the “ever-accelerating” production of clear dental aligners being one way high-end 3D printers are being leveraged for mass customization applications. A key example of this is Prodways’ recently announced contract to 3D print up to a million dental aligners per year as part of a ‘major industrial project.’

While demand continued to grow for industrial 3D printers throughout the latter stage of 2021, the rise of omicron and subsequent supply chain challenges regarding 3D printer parts meant that for many vendors, demand outpaced supply, the report says. Saying this, the report states that global supply chain concerns also caused a new and renewed interest in 3D printing which coincided with the return of in-person events such as RAPID+TCT in the US in September and Germany’s Formnext 2021 in November.

According to CONTEXT, this piqued interest has translated into the order books of industrial 3D printer vendors, leaving the industry “buoyant” and poised for growth in 2022.

Personal and professional growth

CONTEXT’s latest figures suggest that the ‘professional’ 3D printer price class – those selling for between $2,500-$20,000, was least impacted by the pandemic, with its relatively high 2020 baseline making its 14 percent year-on-year growth in the first three quarters of 2021 look less impressive than the recovery growth seen in other price categories. The sector’s growth appears consistently strong, though, as the report says shipments were up not only on 2020’s figures but also came in 13 percent higher than the same period pre-Covid.

The report attributes the sector’s recent growth to new product lines and the expedited introduction of benchtop SLS polymer machines, like the Fuse 1 3D printer from Formlabs.

Looking at the ‘personal’ and ‘hobby’ price class of printers, those selling for less than $2,500 according to CONTEXT’s classification, and the report identified a continuation of the trend of fully assembled personal 3D printers giving way to lower-priced kits, despite demand for both skyrocketing at the height of the Covid-19 lockdowns in 2020. The report states that while demand at the lower end of the market waned and settle into a “new normal” during 2021, shipments remained above 2019 levels.

According to CONTEXT, its Q4 figures will be the most telling for this sector, with current projections suggesting that annual shipments of personal printers could be down by as much as 10 percent on 2020. Despite this, the latest figures state that shipments of personal machines are still up by more than a third on 2019 levels, while kit and hobby printer shipments are on track for at least 36 percent year-on-year growth. Given that sales in 2020 were almost double those of 2019, though, these figures fall short of many vendors’ expectations, the report indicates.

In its report, CONTEXT continues to identify resin-based LCD printers as the “hottest” items in the hobbyist market currently, many of which sell for less than $250.

Looking ahead to 2022 and beyond

According to Chris Connery, VP of Global Analysis at CONTEXT, the key 2022 3D printing trends he expects to see this year include the proliferation of high-temperature, material extrusion thermoplastic printers, composites, binder jetting for metal, and company growth by way of consolidation. CONTEXT also predicts supply chain mitigation and the role of digital manufacturing alongside 3D printing to be central themes going forwards.

The firm projects that the current record backlog looks set to push aggregate system revenues for 2022 up by 23 percent on 2021 numbers. Over the next five years, CONTEXT expects those technologies with mass production capabilities, such as binder jetting, polymer vat polymerization and polymer PBF, to see a CAGR of 30 percent or more in unit volumes.

Cross-analyzing CONTEXT’s figures

Market analyses aren’t always able to capture the full complexities of their target sectors, however in this case CONTEXT’s report seems to echo the recent sentiments of industrial 3D printer manufacturers in particular.

For instance, the report’s suggestion that industrial printer sales are continuing to rebound is backed up by Chinese PBF 3D printer manufacturer Farsoon Technologies achieving its highest ever monthly turnover during November 2021 after rising demand saw it install 500 3D printers worldwide, while fellow market leader EOS announced the delivery and installation of its 1,000th 3D printer in North American in December.

The turbulence of Q3 was also acknowledged by the likes of Desktop Metal, which lowered its full-year financial guidance after it failed to meet its revenue expectations for the period.

Elsewhere, a “dramatic increase in demand” from customers in the space and energy sectors was experienced by VELO3D, with the firm attributing its 278 percent revenue boost between Q3 2020 and Q3 2021 primarily to a rise in its machine sales.

Subscribe to the 3D Printing Industry newsletter for the latest news in additive manufacturing. You can also stay connected by following us on Twitter and liking us on Facebook.

Looking for a career in additive manufacturing? Visit 3D Printing Jobs for a selection of roles in the industry.

Subscribe to our YouTube channel for the latest 3D printing video shorts, reviews and webinar replays.

Featured image shows CONTEXT’s report has identified industrial 3D printer sales rebounded strongly across the globe during Q1-Q3. Photo via Stratasys.